Protest in Armenia, Colombia. All photos by Matt Levin

[T]he motorcycle rumbled over cracked roads in the rural town of Quimbaya inside the coffee-growing heart of Colombia. The driver recognized a spot from his childhood, and said, “This is where my mother used to pick coffee beans.” But the coffee plants no longer were there—rows of banana trees appeared in their place.

During a stop at Hacienda Corcega, one of the largest farms in the area at 248 hectares, farm administrator Ramon Elias revealed the changes happening, including the recent toppling of more than half the farm’s coffee crop, replacing the plots with avocado, lime, and banana.

“We could get rid of all the coffee and make pasture land,” says Elias, 58. “For the most part we’re already getting rid of everything for citrus fruits and for grazing.”

Colombia farmers currently sell their coffee at a loss. Coffee buyers have been paying approximately 70,000 pesos ($22 USD) for an arroba (12.5 kilograms) of coffee beans during the first quarter of 2019. The cost to produce that amount of coffee is estimated between $19–21. Unlike at Corcega, most of the country’s 540,000 coffee producers are smallholders who grow on land no larger than 10 hectares. They survive on modest margins. If earnings from the plant don’t improve, either through intervention from the Colombian government via increased subsidies or a rise in international coffee prices, then the country synonymous with exporting coffee to the world will see the crop disappear from many of its farmlands.

Contending with Threats

An oversupply of coffee has driven down the international prices to prices not seen in more than a decade. Oscar Gutierrez, executive director of the farmworker organization Dignidad Agropecuario, says the issue of overproduction is compounded by multinationals consolidating control in the international market and not passing on profits to producers. His organization formed due to the crisis in 2013, and led a two-week strike in late February of that year.

“It is much more serious this time because the multinationals’ power is much worse,” he says.

Due to a recent small hike in international prices, Gutierrez postponed another countrywide strike set for June 10. But the groups’s demands for the government of Ivan Duque to fulfill promises that his presidential campaign pledged last year to help farmers remains the same.

Colombia is the third largest coffee exporter, and first in exporting mild washed arabica. The National Federation of Coffee Growers of Colombia (FNC) has warned that the area where coffee is cultivated has fallen from more than 948,000 hectares to some 884,000 hectares—representing a drop of 6.7 percent—from 2015 to 2018. As profit margins vanish for farmers, they make the expensive decision to pull up plants and replace them with other crops such as Hass avocados, citrus fruits, bananas, sugarcane, or illicit crops like marijuana and coca.

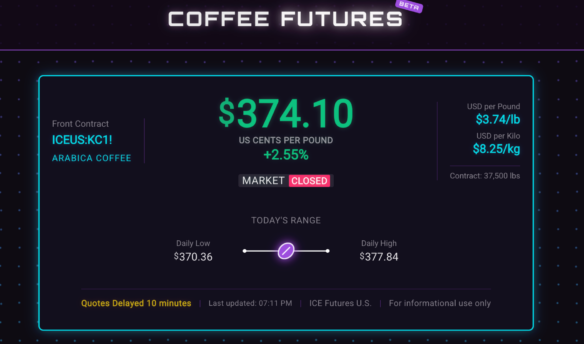

C market coffee prices hovered around the shaky price of $1.30 per pound a year and a half ago. The cost sunk below a dollar in February; while the last two weeks of May saw a sharp reversal in the downward trend, according to the International Coffee Organization, prices remain volatile. Roberto Vélez, the head of the FNC, has been lamenting in the media about how the drop in value is pushing farmers out of the coffee industry. He has urged a fixed price floor of $1.40 per pound as necessary for Colombia’s coffee farmers to earn a living wage.

The sinking C market is not the only danger threatening family-owned farms. Growers worry about the increasing production costs, especially the rising price of fertilizer. They also must cope with less tangible factors like a worker shortage that’s plagued recent harvests, recurrent crop diseases, and the effects of climate change that make weather during the growing season unpredictable. All those obstacles have producers contending with questions about how to feed their families, pay for education for their children, or repay loans.

“We Are Here”

On April 24, Gutierrez led a one-day protest in Armenia, a city of 300,000 people that’s located 15 miles from Quimbaya. A couple thousand representatives from coffee regions throughout Colombia participated in the march. They arrived on packed buses, some traveling overnight from departments a half-day’s travel away to voice their frustration.

Maria Dorado, 56, traveled with other representatives from the small town of Carmelo in the Cauca Department to gather with protesters in Armenia’s city center. She says Carmelo is a place with threadbare infrastructure, and as coffee prices fall, it’s become difficult to provide for her four children.

“The things we earn are only for to eat,” she says. “We don’t bring in money for our kids. The farming does not give enough. So we are here, we left our homes to see if soon the president is going to say, ‘I’m going to boost [help for you].’”

Dorado owes 7 million pesos ($2,000 USD) on her 10 hectares of land. She has started substituting sugarcane for coffee on parts of her coffee in the hope that diversifying will secure more income.

José Tolima, 42, needs to pay back several million pesos in debt as well. He and dozens more members of the Misak indigenous group walked in traditional attire through the streets of Armenia as they called for government assistance to sustain a practice that goes back generations for the tribe and many other rural Colombian families.

The most persistent request from Dignidad Agropecuario is the creation of a stabilization fund that would store money during more prosperous growing seasons and disburse the savings when the market price falls. Farmworkers also want the government to provide subsidies for fertilizers and to restructure loans. The FNC has mused about making a more significant structural change, delinking from the C market altogether, and setting a minimum selling price to multinationals, through, among other things, cooperating with other coffee-exporting nations.

Not Enough

Despite showing sympathy for the smallholders, the FNC has deemphasized a need to strike, preferring to continue negotiations with Duque’s government on the stabilization fund and other potential boosts to farmers. The Agriculture Ministry has denounced calls for a protest, declaring that the government has already dedicated approximately $80 million to subsidies and additional forms of aid for growers. But protesters insist that’s not enough to deal with the current crisis.

Janina Grabs, a political economist at the University of Münster, attributed the low market prices on the commodities market to a sizable part to record yields in Brazil last year. The South American giant produces both high-quality arabica beans and lower-grade robusta, and high forecasts for Brazil’s future output continues to contribute to overproduction and drags down C market prices. Grabs noted that Brazilian producers can endure lower prices more easily than other coffee-producing countries since coffee plants are grown on flatter lands and can be harvested with mechanized pricing. That makes production cheaper than in places like Colombia where coffee must be handpicked.

Still, even before the recent crisis, coffee production paid too little. While the coffee price for consumers has increased seven-fold since the 1960s, says Grabs, the nominal price paid to producers hasn’t budged much higher. The economist added that leaving the C market and forming a commodity agreement with other countries could be gauged as a long-term solution for Colombia’s underpaid smallholders. In the meantime, assistance such as a stabilization fund looks necessary to provide the capital growers need to tend properly the crop. Without receiving that assistance soon, future outputs could be blunted.

“Even in the next year, if prices recover it means you have lower yields for a couple of years,” says Grabs. “The lower level of effort and care you were able to provide your coffee plants continues on into this negative spiral.”

Elias, the administrator at Corcega, has watched farmlands around the region forsake coffee for banana trees. The intensifying strain on coffee production makes him skeptical about what type of output to expect in the fall when the majority of coffee harvests occur in Colombia. He’s worked on farms his whole life and wonders what it means for the agriculture’s future if the country’s most esteemed export cannot be saved.

“Coffee is the only product that moves the people. It moves the economy. It moves the world. It moves the Jeeps that transport the coffee, it moves the storehouses,” he says. “If there is no coffee, there is nothing.”