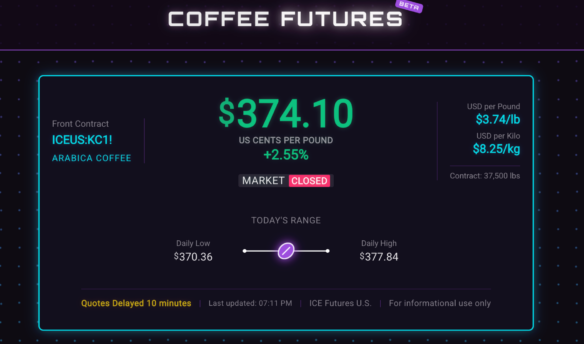

[C]ash has traditionally been the payment of choice at coffee shops across the country. After all, it’s immediately accessible and there’s no risk of consumers disputing transactions like they can with a credit card. That attitude is changing, though, since customers just aren’t carrying as much cash as they used to. A 2014 survey by Bankrate found that 40 percent of those surveyed carry less than $20 on a daily basis. Mobile payments tied with customer loyalty programs are becoming popular at many coffee shops—Starbucks has a widely used app and many smaller operators use apps like LevelUp. Cheaper credit card processing through cheaper services means most cafés have made the shift to accepting cards.

Most credit card processors charge a percentage of each transaction plus a small per-transaction fee, which cuts into the thin margins of high-volume, small-ticket businesses like coffee shops. A restaurant where the average ticket is $50 has an easier time absorbing those fees into its margins compared to a coffee shop where the average ticket might be a tenth of that.

“Companies like Square are bringing innovation to the field where small merchants can have relatively low processing fees,” says credit card and payments industry expert Tom Dailey. “But even the innovative companies charge a per-transaction fee plus a flat number of cents. When it’s a small transaction, each small fee can dilute revenue.”

Many cafés fall somewhere on a spectrum of payment acceptance, perhaps enforcing a minimum for credit card transactions (by law, credit minimums cannot exceed $10 and are not allowed on debit card transactions) or requiring cash but providing access to an ATM.

Mother Fool’s Coffeehouse in Madison, Wisconsin opened in 1994, and co-owner Jon Hain plans to remain proudly cash only for as long as possible. “Twenty years ago, it was far more expensive to maintain a merchant account,” he says. “The costs have come down but we have also a philosophical concept at play.”

Mother Fool’s ethos of buying local and operating a single location doesn’t jibe with the idea of paying a percentage to a payment processor, Hain says. “There’s a desire to keep the money right here and as time has gone on and I’ve learned about the trend toward a cashless society, I don’t like it,” he explains. (Hain and others worry that those who don’t have a traditional bank account or credit card could be excluded from a cashless society. Immigrants may also have challenges qualifying for bank accounts or credit cards.) “It’s going to lead to a lot of pain, but we may be forced at some point to go cashless,” Hain admits.

Mother Fool’s doesn’t accept plastic, but accepts personal checks, and Hains says they’ve only had one or two bad checks per year. “We’ve been really lucky with it,” he says. “In most cases that’s been an accident.” Regulars who don’t want to carry cash sometimes bring in a larger check once a week to purchase a gift card they can use to get their daily caffeine fix.

Another concession to consumers’ shift away from carrying cash: an on-site ATM added a few years ago. Hains says they noticed a few years ago that “all of a sudden everyone had plastic and people were whipping out a credit card for a $2 coffee.” Not only does the ATM provide convenience to patrons and baristas, but it’s also convenient for those in the neighborhood who stop in to get cash (some people get coffee too, some not).

Common Grounds Coffee in Cleveland has also been cash only since it opened nearly two decades ago. When Raphe Neapolitan and his partner purchased the coffee shop last year, they considered accepting cards, but decided against it due to the processing fees and the fact that its patrons are used to paying cash.

“It would be tough to open a coffee shop and be cash only,” Neapolitan says. “But it’s always been cash only. The neighborhood doesn’t have a problem with it.” (Neapolitan also owns a beer and wine shop that accepts credit cards with a $10 minimum, but the nature of the other business means higher average spends per transaction compared to a coffee shop.) Frequent drops at the bank next door help alleviate concerns over building up a large stash of cash on the premises, Neapolitan adds.

Since Common Grounds is open twenty-four hours, 365 days a year, it attracts a lot of younger people who may not have credit cards anyway. Like Mother Fool’s, Common Grounds has an ATM on site, which was added a few months before the change in management. “We get a lot of action on the ATM,” Neapolitan says. “When people are walking from bar to bar they’ll come in and use it.”

However, a cash-only policy does exclude business customers who want to pay for coffee with a corporate credit card and expense it. “We do lose out on those sales,” he says. “That’s a bummer and we need to find a way to incorporate that.”

Cash-only businesses not only miss out on business customers, Dailey points out that the higher amounts charged on a credit card may also help offset processing fees. Several studies show that consumers are more willing to spend higher dollar amounts when they’re using plastic, perhaps because they don’t have the visual reminder of paper money leaving their wallets. For coffee shops that also stock items like fancy mugs or coffee grinders, accepting plastic could help move those bigger-ticket items, he adds.

Meanwhile, Koffee? in New Haven, Connecticut, opened in 1992 and has eased its credit card policies over the past several years. Koffee? had been cash only, but about six years ago began accepting credit cards with a $10 minimum. Two years ago, owner Duncan Goodall (who bought Koffee? from the original owners in 2002) eliminated the minimum on credit cards and says he’s playing around with the getting rid of cash altogether.

Part of this shift has been driven by lower processing fees. “For small-transaction businesses like mine, that’s made a huge difference,” Goodall says.

Recent shifts in consumer behavior are another factor. “Fewer people have cash,” Goodall says. “You can easily piss off your customers if you don’t take credit cards, especially the millennials who don’t even carry cash. The piss-off factor is not worth it.”

While many owners dislike credit card processing fees, Goodall points out that cash has handling costs too. “You have to make cash bags every day,” he says. “After the shift is done, you have to reconcile the fees out from the register. That takes time as well, but that doesn’t even take into account you have to take the cash to the bank and buy more change.”

Goodall also dislikes cash because of the potential for employee theft. “Anytime you have a cash-based system, at some point in time people are going to rip you off,” he says. “It’s difficult to design and set up a system that tracks cash well.” With mobile and credit card payments, it’s harder for money to go missing from the register.

Still, Goodall sees his coffeehouse moving towards going cashless. “I suspect that over the course of the next eight to ten years, cash is going to just gradually be eliminated. There’s a continual reduction to where I could reasonably run my business without it.”

Another argument in favor of plastic: some consumers “view merchants that accept credit cards as being more established and credible,” Dailey says. Card processors have democratized payments and provided access for merchants who haven’t qualified to take credit in the past, so the perception is not always accurate, but it persists.

Changing payment policies means weighing several financial, logistical, and sometimes even philosophical considerations, so there’s hardly a one-size-fits-all solution.

—Susan Johnston Taylor is a freelance writer who covers small business.