🔴 7/10/25 Update 🔴

The Trump administration has announced a handful of deals with foreign nations that include tariffs on imports in the last 60 days, though not all of the announced tariffs have taken effect. Most notably:

55% tariff on imports from China (active)

50% tariff on imports from Brazil (threatened to go into effect August 1st)

20% tariff on imports from Vietnam (announced July 2nd, not yet active)

20% tariff on imports from the EU (delayed until August 1st)

President Trump announced sweeping “reciprocal tariffs” on April 2, 2025, dubbed “Liberation Day.” The order imposes country-specific tariffs ranging from 10% to over 40% on goods from more than 180 countries, with a baseline 10% tariff on nearly all countries effective April 5, 2025.

As the U.S. imported more than $8.2 billion worth of coffee in 2023, the National Coffee Association warns that these tariffs could significantly increase consumer prices and disrupt established supply chains.

Originally Reported on April 3, 2025

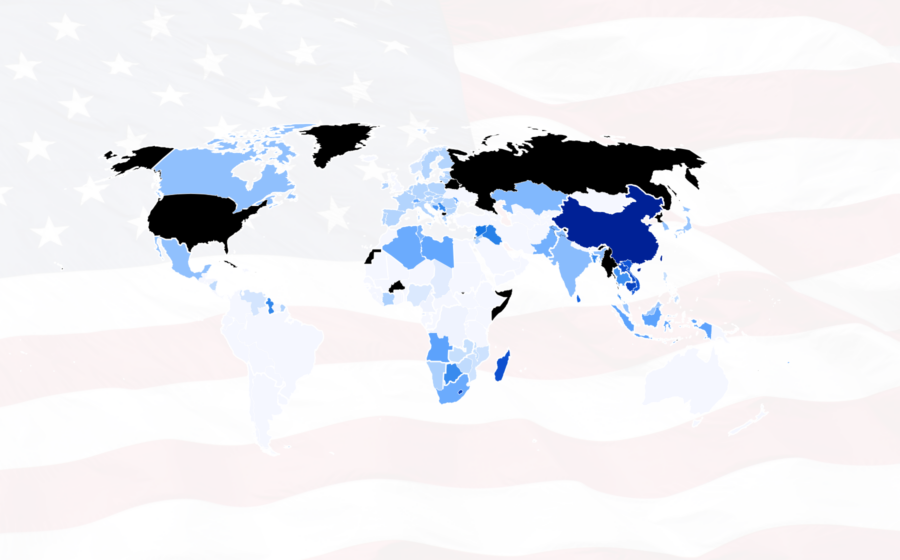

Explore the map to monitor tariffs on coffee-producing countries:

Tariffs will impact the U.S.’s relationship with producing countries differently.

China faces one of the highest rates in the new Trump tariff structure, at 34%, which the Treasury Secretary clarified will be added to existing tariffs for a total of 54% on Chinese imports, including coffee. China exported $99.2M in coffee in 2023, making it the 36th largest exporter in the world.

Mexico faces a 25% tariff generally, though green, unroasted coffee is considered a “USMCA-compliant good” with privileged status, meaning the Mexican tariffs will not apply to green coffee.

Brazil is the largest supplier of coffee to the United States, and appears to face a relatively modest 10% baseline tariff under the new structure. However, Brazil’s supplies were already critically low following last year’s severe drought, with arabica prices at record highs. The addition of even modest tariffs could exacerbate an already tight supply situation.

Vietnam is the world’s second-largest coffee producer and a major robusta supplier, and now faces a steep 46% tariff rate according to the announcement. Other countries known for robusta production, including Laos and Cambodia, also face high tariffs.

The National Coffee Association has formally requested that coffee be exempted from tariffs entirely, arguing “there is no alternative to imported coffee, unlike other cases where tariffs may address unfair practices or incentivize domestic producers.” Coffee professionals should monitor these exemption efforts closely, as they could significantly alter the tariff landscape.

The implementation of these tariffs comes at a particularly challenging time, as coffee prices had already reached record levels, with arabica trading above $4 per pound in February due to supply shortages. For coffee businesses, developing contingency plans and maintaining flexibility in sourcing will be essential as this situation continues to evolve.