[O]ne of the critical factors that determines whether a business can improve its performance and product is its access to affordable credit. Without the ability to take out a loan, a roaster’s growth might plateau for want of more drum capacity. Without a credit card, a busted espresso machine could bring down a café. In coffee consuming countries, we fret over the terms and interest rates of credit cards and loans—it’s the affordability that makes us sleepless—but we rarely have to worry about access to credit.

For the vast majority of smallholder and even medium-sized coffee farmers, access is the main problem.

Let me define a couple things before we dive in. A smallholder is a farmer who, generally, owns only a few hectares of land (a hectare is roughly two and a half acres). Most farmers receive one, annual payday, which they have to stretch for a year. When I talk about credit and access to financing, I mean transactions that resemble the sort you’d expect when seeking a personal or business loan: one involving an institution that’s part of the legal economy. For a smallholder, a decent loan would be in the hundreds of dollars.

With that money, a farmer can make major improvements to her farm, says Nate Schaffran of Root Capital, a financing firm that provides loans to farmer associations. “Putting in things like irrigation, new cultivars, investing in inputs and labor to do proper pruning, those investments can make quite a difference to the yield and profitability of the coffee farm,” he says.

The problem is getting that money.

The biggest obstacle to credit or financing for farmers is they have zero access to banks. International banks are limited to major cities, and even local banks don’t have branches in rural, agriculture communities. The financing farmers need and the collateral they posses (likely just a small spot of land on a far-flung mountainside) aren’t worth the hassle for a bank.

Even if they had access to a bank, procuring a credit card is impossible except for the wealthy in most developing countries. Again, it’s a collateral problem. I can take out a dozen credit cards because banks know they can garnish my wages and they’re pretty sure I don’t have the wherewithal to disappear into the gray economy (and they are very right about that); economies and infrastructures in poor countries can’t protect the lender this way.

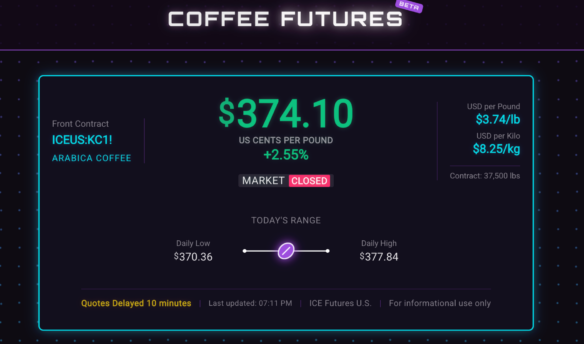

Even with no banks, most farmers have access to small loans, but in the guise of a loan shark or coffee buyer offering what’s essentially a futures contract, often a highly disadvantageous one. In this second scheme, farmers will sell their upcoming crop, or a portion of it, to a local buyer for upfront cash. Regularly, this payment is a fraction of what the farmer would get even from commodity prices during harvest. The farmer does this because it’s often the only way to get cash during the thin months, the meses flacos discussed in last month’s Origin column on food insecurity. The farmer loses money, but the family eats—just one more example of the adage that it’s expensive to be poor.

Loans from family and friends are common, like everywhere, but there are few rich uncles in these communities.

To deal with these limits, many rural communities organize savings and credit cooperatives, which operate essentially like credit unions. Schaffran says they can be quite sophisticated despite their small size. These co-ops are often the safest avenue for loans, and farmers use small loans for anything from wages for off-harvest labor, school tuition, or inputs like fertilizer. A bigger loan could finance an irrigation project, drying beds, or switching to rust-tolerant trees. These are the equivalent of a roastery buying a new roaster or a coffeehouse owner opening a second café.

Not all improvements available to a farmer are available to her as an individual, and major capital investments often require collective action. If a group of farmers, likely as a co-op since the number needs to be in the dozens, takes out a loan to construct a small wet mill, Schaffran says there’s a benchmark of 20 to 30 percent increase in the price they’d get for their coffee. Going from hand-pulped to centrally pulped, they see a higher and more uniform quality. They can also sell in bulk earlier in the year rather than storing it as parchment on the farm, where it would degrade.

This type of loan would be in the tens of thousands of dollars. Even at that amount, it can be difficult for the group of farmers to acquire the loan. A capital loan isn’t worth it for a bank until it crests $2 million. If the group wanted less, they might be able to access micro-financing, but the problem is in the “missing middle” as it’s called by the Council on Smallholder Agricultural Finance, a group of eight financial organizations that includes Root Capital, which offer financing in the $25,000 to $2 million range. For the lack of what we’d call a small loan (what many café owners have put on credit cards), dozens of farmers are missing out on a life-altering increase in their coffee’s value.

Another source of financing has been ad-hoc loans by direct-trade roasters. When you hear about direct-trade relationships that include roaster-financed projects like raised drying beds or even wet mills, these are small numbers for the roaster’s books but major capital investments for the farmers.

It’s a relatively small amount of money, but it’s money they couldn’t get otherwise; it’s money that could change their fortunes.

—Cory Eldridge is Fresh Cup’s editor.