From classic iced coffee to nitro cold brew, cold coffee drinks are incredibly popular among today’s consumers. But despite favorable forecasts for the wider category, sparkling coffee—which sits at the intersection of soda and coffee—hasn’t yet found its spotlight.

Ready-to-drink (RTD) sparkling coffee, also known as coffee soda, is simply carbonated coffee, sometimes with added flavors. As Jenny Bonchak, founder and CEO of North Carolina’s Slingshot Coffee Co., told Perfect Daily Grind in 2021, “We take something that you know and love, which is soda water, and we pair it with something else you know and love, which is coffee.”

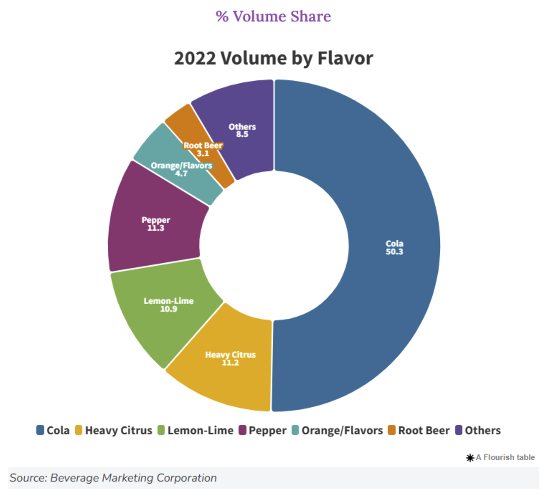

The combination isn’t entirely new: Manhattan Special has been selling bottled coffee sodas since it was founded in 1895 by Italian immigrants to Brooklyn. Although the brand remains popular, coffee soda generally has taken a backseat to more classic flavors like cola and root beer, which also date to the 19th century. While multinationals like Coca-Cola and PepsiCo have introduced coffee flavors into their sodas since at least the ‘90s, they’ve seen mixed results. Then, in the late 2010s, dedicated sparkling coffee companies like Upruit, Keepers, and VIVIC Coffee came on the scene with coffee RTDs featuring novel flavors—like VIVIC’s lavender and sarsaparilla sparkling coffees—but closed soon after.

So why has coffee soda struggled to resonate with consumers? Although both coffee and soda have caffeine as a common denominator, they’ve historically been enjoyed in different contexts, and at different temperatures. It’s not until recently that coffee gained popularity as a cold, carbonated drink à la cold brew.

Such trends have created a new opening for sparkling coffee: Demand for cold coffee RTDs dovetails with rising consumer spending on other sparkling, non-alcoholic beverages like prebiotic sodas. (In fact, bubbly drink sales were up 16% in 2024.) These newcomer sodas often come with wellness claims and a wide range of flavor options, including profiles that draw on the long history of classic fountain sodas.

In the 2020s, both new and established brands are continuing to take up the coffee soda baton. The times are ripe for change, and companies that can navigate the right balance of novelty and familiarity may just gain ground with consumers.

The Sparkling Coffee Landscape

Many specialty brands that offer sparkling coffee also sell cold brew, like Slingshot, so it’s not hard to compare the products’ trajectories.

Market analyses of coffee RTDs tend to conflate the two terms or lump the categories together, even though the drinks are very different. But whereas sparkling coffee is still somewhat niche, the growth of RTD cold brew shows no signs of slowing down across supermarkets, convenience stores, and retail businesses worldwide. Forecasts for the global cold brew market between 2025 and 2032 show an annual growth rate of 22.7%, compared to 13.20% for sparkling coffee in the same timeframe.

Consumer expectations may be the reason sparkling coffee RTDs haven’t yet attracted the same attention as cold brew. Cold brew is recognizable and available at most coffee shops, while the combination of carbonated coffee and fruit flavors is still new to many.

When it comes to carbonated soft drinks, consumer surveys show that classic flavors like cola, citrus, and lemon-lime are still heavy hitters. “All too often, new flavors have fleeting success [but] innovation remains an important way to bring excitement to the category,” wrote Gary Hemphill, Beverage Marketing Corporation’s managing director of research, in the April 2024 issue of “Beverage Industry.”

That was the case with the short-lived Mazagran, a bottled coffee soda made by Starbucks in 1994 which then-CEO Howard Schultz later called “a niche product” that “polarized people.”

Nearly 30 years later, brands still find it challenging to make inroads with sparkling coffee. Companies like Keepers (founded in 2016 in New York), Upruit (also founded in 2016 in New York), and VIVIC (founded in 2018 in California) launched eye-catching RTDs and garnered a lot of press and positive sentiment—but all went out of business within half a decade.

Alldae Superfruit Soda has differentiated itself by using brewed, carbonated cascara as a base for its RTDs. It’s also successfully pivoted in response to changing consumer expectations.

When it first launched as Alldae Cascara in 2021, the brand’s original-flavor RTD offered “plain carbonated cascara, no added sugar,” says CEO and founder Ryan McDonnell. “People said they liked it, but they couldn’t pin down the taste.” (Cascara is brewed from dried coffee fruit, which is often said to taste more like tea than coffee.)

In 2023, the New York-based company rebranded as Alldae Superfruit Soda to make its concept more accessible, while introducing three new flavors: Ginger Yuzu, Passionfruit Guava, and Hibiscus Dragonfruit. Now, McDonnell says the drinks are “really resonating” with consumers.

Brands continue to adapt product offerings as they learn more about their audience’s preferences. German coffee retailer Tchibo launched Mazagrande in 2016, a cold-brewed carbonated coffee drink with citrus flavors, dubbing it a “coffee lemonade,” and added Cofizz, a bottled sparkling water that incorporates fruit aromas and caffeine extracted from coffee, in 2021. Despite debuting at U.S. trade fairs in 2024, Mazagrande was retired the same year, wrote Steffen Saemann, the marketing director for Czechia and Slovakia, in an email. Meanwhile, “Cofizz sales have grown by double digits each year.”

Since its founding in 2012, Slingshot gained a foothold by first establishing itself in cold brew. But by 2018 it had begun to introduce coffee sodas like Citrus Vanilla Cream Soda, Black Cherry Cola, and Vintage Root Beer. Founder Jenny Bonchak wrote in a press release that the RTDs “reflect our modern twist” on “classic soda flavors.” Drawing on the long history of such flavors, the brand calls its Vintage Root Beer “childhood all grown up.”

The Anatomy of Nostalgia

Other brands that specialize in sparkling coffee have struggled with longevity. In 2017, Keepers’ co-founders told CNBC that their journey started with an office seltzer machine and different combinations of coffee, fruit juice, and sweeteners. Their citrus and black sparkling coffee RTDs even appeared in Whole Foods. But by 2019, they’d quietly closed up shop after three years in business.

“I think it’s challenging to create something that consumers will understand at a glance and have a part of their regular lifestyle,” says McDonnell.

Long-standing brand recognition helps, however. Consumer Lana Lauriano, a third-generation Italian-American, grew up drinking Manhattan Special’s bottled coffee sodas in New York. Now that she lives in the Pacific Northwest, she can’t find them anywhere, though she looks every time she’s on the East Coast.

“Nostalgia is a huge part of it. When I see [the soda], I can visualize it in my grandparents’ fridge,” she says of the espresso coffee soda, which is made with Italian espresso, seltzer, and sugar. “It always brings me comfort and reminds me of home.”

A coffee soda might gain a bigger following if it’s first launched within the context of a cafe environment. Nashville’s Crema Coffee Roasters were trying to develop an espresso tonic drink when they instead hit on a recipe for house-made coffee soda, says co-creator Rachel Lehman. Thirteen years later, Crema cafes serve a coffee soda six months of the year, while it’s warm in Tennessee.

In an email, Lehman described the enduring formula for the coffee soda. It starts with freshly brewed Japanese-style iced coffee and a homemade simple syrup made from demerara sugar, which adds a natural caramel flavor, as well as citric acid. This mixture is then carbonated in one-liter bottles. A fresh coffee soda consists of the “charged” coffee poured over ice and with a twist of orange peel to serve.

Despite the drink’s popularity, Crema decided not to pursue a packaged RTD version “in order to preserve the original intent and integrity of the drink [which was designed to be] made fresh daily and enjoyed in our cafes,” Lehman says. “In the early days, we experimented with kegging it. But we quickly realized if we were to scale up or can it, we’d have to change the composition of the drink.”

Although Crema has done seasonal iterations, the classic coffee soda has become such a “staple” that “we don’t mess with the original recipe too often.”

It’s a sentiment that rings true for many consumers. Lauriano doesn’t plan to try any coffee sodas other than Manhattan Special—and such brand loyalty, whether to cold coffee RTDs or soft drinks, may be a high bar for newcomers to clear.

Ultimately, the success of new products may depend on a company’s ability to seamlessly combine modern and classic—while “sparkling coffee” feels novel and unexpected, “coffee soda” evokes welcome nostalgia. Coffee brands looking to launch carbonated drinks can also diversify with dependable sellers, like cold brew.

Whichever term you use for this up-and-coming category, there may be a reason it hasn’t seen such explosive success. “My gut says that the world isn’t ready for coffee sodas quite yet,” says McDonnell. “[Although] the coffee piece of it is unique, […] soda is a hard market to differentiate yourself in.”

Photos courtesy of Crema Coffee Roasters unless otherwise noted