This story was researched and written by Fresh Cup in partnership with our sponsor, Ghirardelli.

In 2025, mocha prices are all over the map.

Go to any city, and you’ll likely find one spot proudly serving a $4.50 12oz mocha just blocks from a cafe charging $6.25 for the same drink. Who’s overcharging, and who’s leaving money on the table? And what makes mocha pricing so divergent in the first place?

It’s true that coffee shops have raised their prices due to inflation, supply chain issues, and tariff-related uncertainty. But price increases have not been applied evenly across businesses and drink types. That’s probably because raising prices is frightening: Coffee discussion boards are filled with cafe owners voicing fears of scaring off regulars. It can be challenging to figure out just how much a menu item needs to go up to cover rising costs—and that challenge compounds with mochas, whose price and value can change based on the quality of the chocolate used.

So what’s a cafe to do? In a time when shop owners have to make tough decisions on pricing, creating a benchmark of data can eliminate the guesswork—and clarify exactly what a mocha should really cost.

That’s what we’ve done below. Fresh Cup analyzed 100 coffee menus across the country, and looked at consumer research data to figure out how shops should approach mocha prices in 2025. Not only did we look at average prices, but we also examined how chocolate quality influences what customers are willing to pay.

The Mochanomics of 100 Coffee Menus

We collected pricing data from a wide range of coffee businesses, including cafes, coffee shops, coffee trucks, and bakeries. The selected businesses represent a variety of regions and population densities..

Then, we looked at their pricing for the following four drinks:

- 12oz lattes

- 16oz lattes

- 12oz mochas

- 16oz mochas

To keep things simple, we defined both lattes and mochas as hot drinks. We also only looked at the basic versions of both drinks—no peppermint flavoring or whipped cream here. For our purposes, a mocha is a latte with chocolate in it.

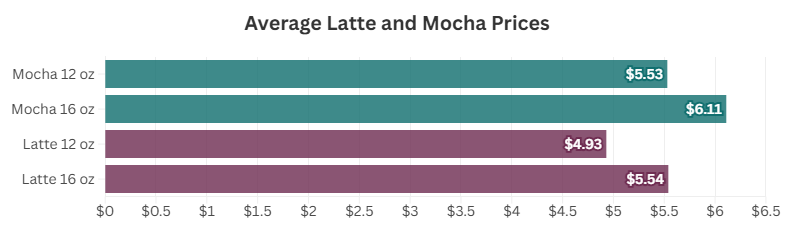

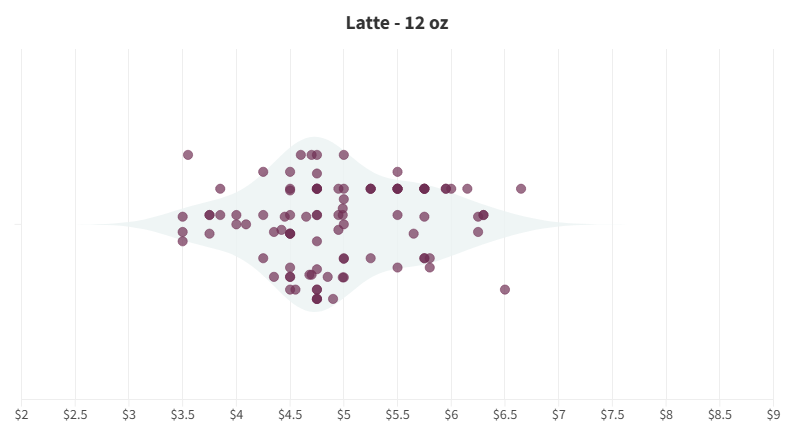

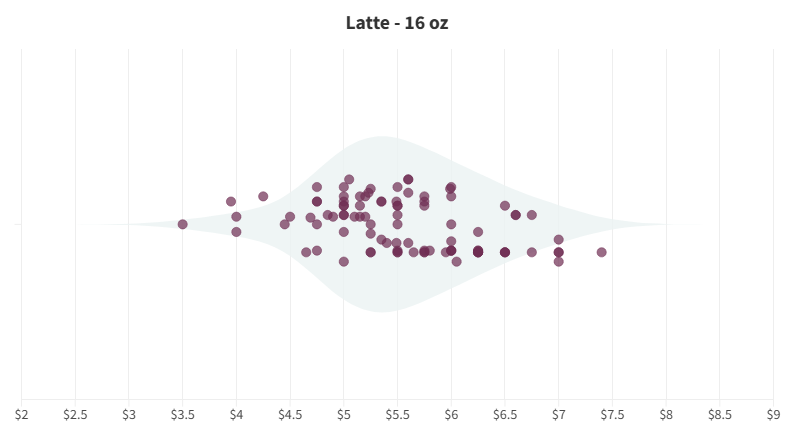

Across 100 menus, we found that a 12oz latte averages $4.93 and a 16oz latte costs $5.54. Add chocolate, and the price jumps—12oz mochas average $5.53 and 16oz mochas $6.11.

Mocha prices have been rising consistently for years now, according to menu data from point-of-sale provider Toast. Its data shows that prices for beverages with “mocha” in the name increased 4.7% from Q3 2023 to Q3 2024.

“This tracks with what we’re seeing,” Dave Dulyx, VP of Ghirardelli Professional Products, tells Fresh Cup. Dulyx says current menu hikes indicate “healthy, measured increase. It reflects inflation and rising ingredient costs—particularly since cocoa is at a 50-year peak and will likely persist until at least late 2026.”

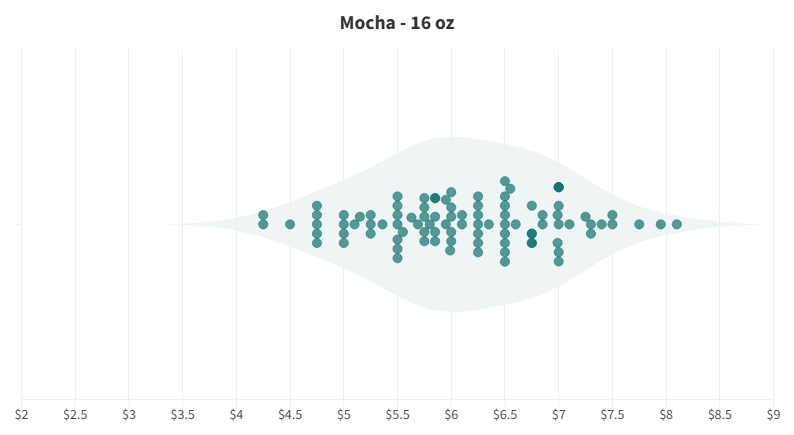

Chocolate Fish, an award-winning roaster with four locations in Sacramento, California, is one such business that recently raised its prices. “This is actually the first time in years we’ve done a pricing increase in our cafes … to keep reasonable pricing without losing out on our margins,” says Maxx Leekley, production lead and inventory manager for Chocolate Fish. “Our 12oz mocha is now $6.25, and the 16oz is $6.75.”

Adding chocolate to a drink seems to cost about half a buck: The median latte-to-mocha price increase is $0.50. Roughly one in four of the locations we surveyed charges more than $0.80 to go from a plain latte to a mocha, and about one in 13 charges more than $1 to make the upgrade.

Most menus treat the jump from a 12oz to a 16oz drink as a $0.50–$0.75 price increase, with the median coming in at $0.60 for both regular lattes and mochas. $1+ size‑ups exist in our data set, but are uncommon.

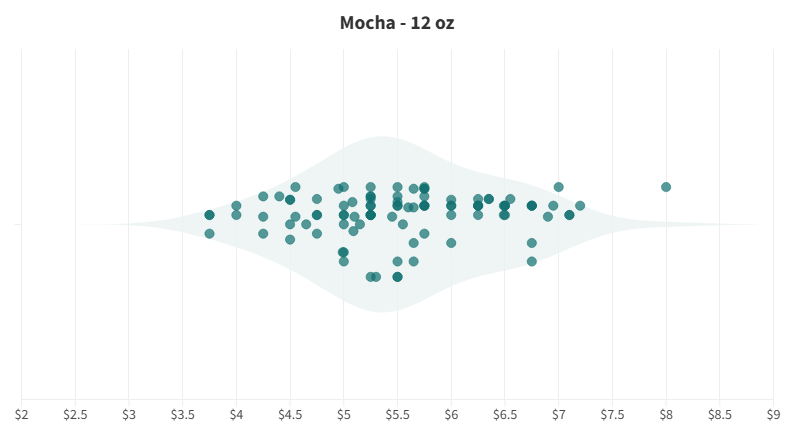

Charts: These charts mapping price distribution highlight just how spread out latte and mocha prices can be. While most cluster in the middle, there are plenty of outliers—shops charging under $3.50 on the low end and pushing $8.50 on the high end.

So what does all this data mean? It means if you’re charging less than $5 for a 12oz mocha, it might be time to reconsider your menu options. But for shops looking to measure how quality can impact customer expectations and sales, there’s more to factor in.

Technomic Research Indicates Who Can Charge Even More

The gap between the lowest- and highest-priced mochas in our data set is almost $2. There are a variety of factors that could produce such a gap—neighborhood affluence, brand perception, the cafe owner’s boldness in raising prices—but those aspects are difficult to quantify.

Instead, we looked at data from Technomic, a leading foodservice research firm. The company tested customer preferences and willingness to pay for chocolate beverages and desserts in order to help shop owners understand how buyers think about pricing.

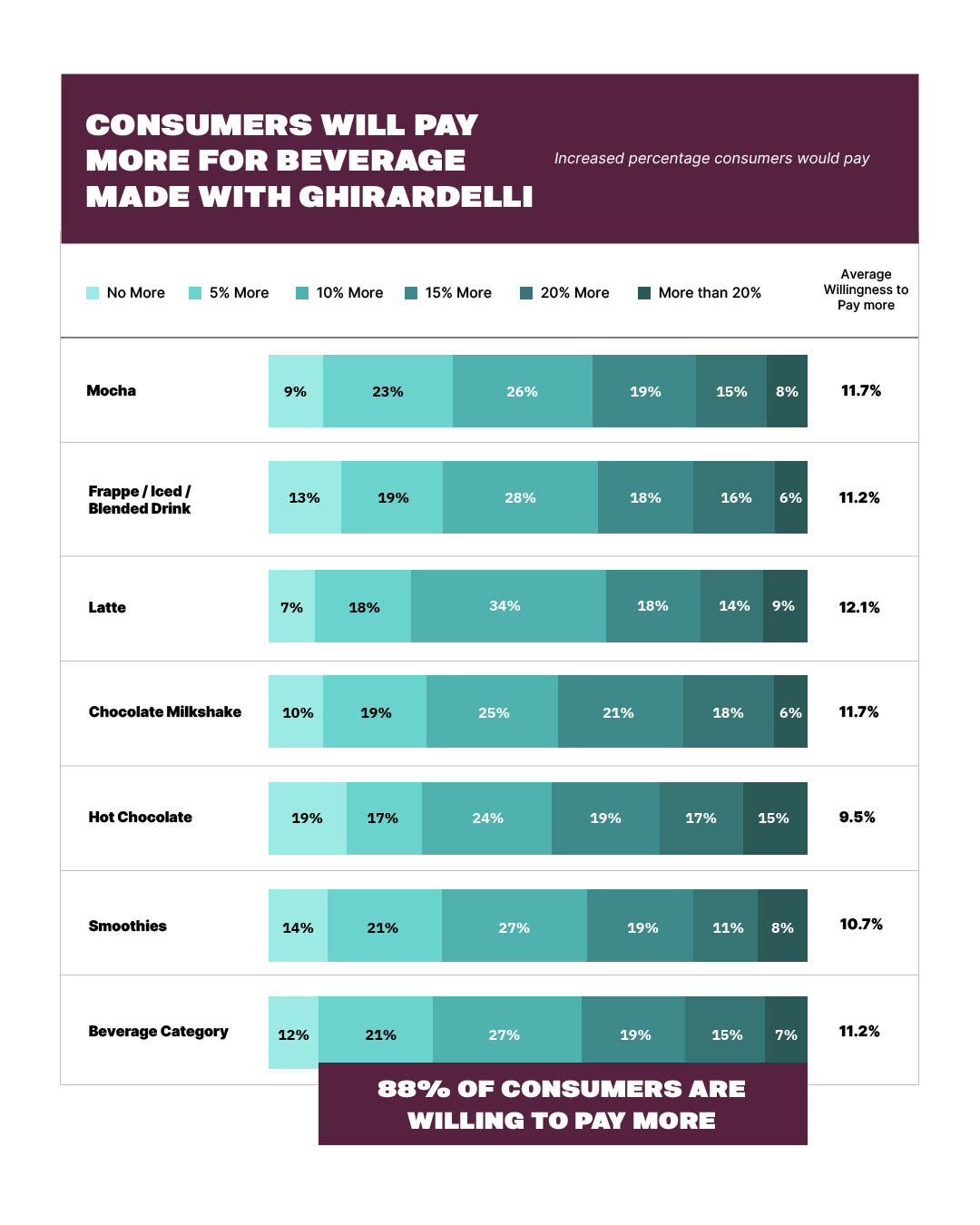

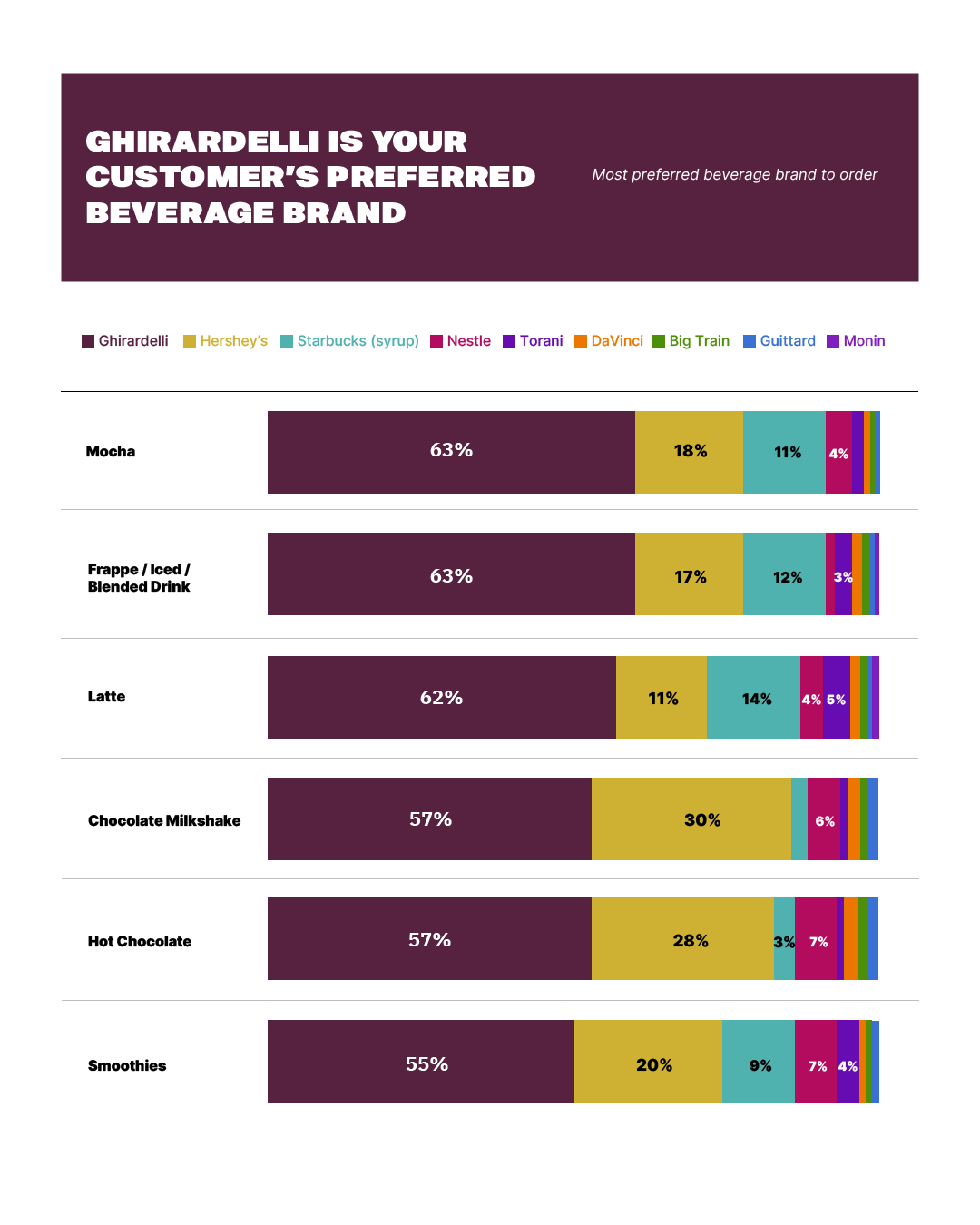

According to the research, 88% of customers are willing to pay more for beverages made with Ghirardelli. The study looked at thousands of customers to gauge how willing they’d be to pay for different kinds of coffee drinks. Technomic found that the average increase customers will accept is 11.7% for “mochas” and 12.1% for “lattes” (think lattes that feature Ghirardelli, but aren’t classic mochas, like “caramel latte”) made with Ghirardelli, compared to the same drinks made with generic ingredients.

Dulyx isn’t surprised by this data. “We see the key drivers of consumer preference being quality and perceived value,” he says. “Ghirardelli is synonymous with premium chocolate, so consumers recognize and associate the brand with quality and taste.”

Willingness to pay can change from market to market. Chocolate Fish takes a customer-centric approach to find what works for its customers. “We price our drinks based on what we think customers are willing to spend,” Leekley says. “We’re a specialty coffee shop, which means people expect a certain quality. We usually start with a concept or a flavor profile we want to work with and go from there. Our staff and management always provide extensive feedback on drinks before we serve anything to the public.”

The Chocolate Fish team recently released S’mores Latte that features both Ghirardelli Chocolate and White Chocolate Flavored Sauce as an example of a drink that went through multiple iterations before being put on the menu. “We eventually landed on a black-and-white mocha base with a sweet cold foam, drizzled with chocolate sauce, and topped with graham crackers.”

Using products from well-regarded brands doesn’t just help customers think positively about those specific beverages, but about the company overall. Technomic found that 79% of consumers believe businesses using Ghirardelli offer higher-quality products, leading to a halo effect for the entire business.

When customers were asked to choose their preferred chocolate partner for coffee beverages from a list of leading brands, nearly two-thirds chose Ghirardelli—more than any other manufacturer in the research set.

This perception of quality is what originally drove Chocolate Fish to carry and serve Ghirardelli products in its cafes. “Ghirardelli is such a recognizable and well-loved brand,” Leekley says. “It felt suitable to serve something as noteworthy as Ghirardelli for both our chocolate- and white chocolate-flavored options in our cafes.”

When considered alongside our research, Dulyx believes these findings represent great news for coffee brands that want to pursue quality but have been worried about increasing costs. “Quality drives perceived value more than discounts, promotions, or sizes,” he says. “Meaning you can improve both margins and customer loyalty simultaneously, rather than having to choose between profitability and competitiveness.”

It’s worth noting that these gains in willingness to pay and brand preference only apply when customers can clearly see that drinks feature Ghirardelli ingredients. “Raising prices only works when paired with prominent brand callouts on the menu,” Dulyx says. “Raising prices in isolation won’t deliver results. If you’re switching to a premium brand like Ghirardelli, you need to communicate that switch to your customers to justify the price increase.

“Brand visibility and pricing work together as a package—one without the other misses the opportunity to elevate your offerings … and re-invest in quality.”

Should You Change Your Mocha Prices? Here’s What the Data Suggests

As a result of our analysis, here’s how we think cafe owners can approach mocha and latte pricing to reflect both rising costs and the value customers are willing to pay for.

First, evaluate your pricing. If your prices are well below average—or if you’re charging less than $0.60 for a 12oz to 16oz mocha upgrade—you likely have room to nudge prices upward without turning customers away.

If your market can afford it, leverage willingness to pay for Ghirardelli or other brands that serve as quality markers. Technomic’s data shows customers are willing to pay 11.7% more for mochas made with Ghirardelli. Using Ghirardelli products—and publicizing that—may be your ticket to additional price increases beyond the average.

Keep inflation in mind. Coffee drink prices are going up across the board. The USDA projects prices for all food to increase 2.9% over the course of 2025, with food consumed away from home predicted to rise as high as 4.2%. Build inflation expectations into your pricing strategy.

This is an industry where margins matter and every drink counts. Get your mocha pricing right, and you’re one step closer to building a sustainable business model that lets you invest in quality, pay your team fairly—and keep serving great coffee for years to come.

Sponsored by Ghirardelli