To call the last week chaotic would be an understatement. After months of uncertainty, and several threats that never quite came to pass, the Trump administration announced on Wednesday, April 2 that it would place sweeping tariffs on nearly all countries that trade with the United States.

Then, President Trump went golfing.

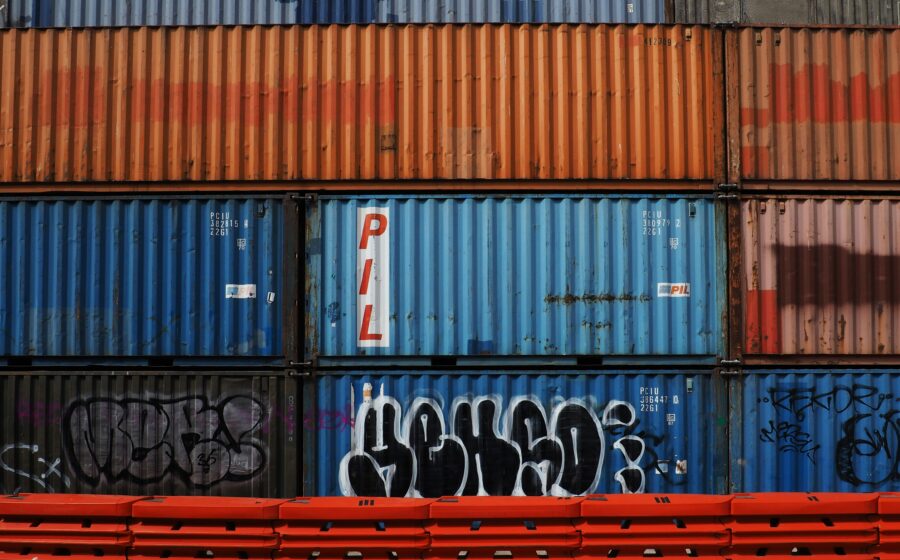

The tariffs, which went into effect over the weekend, range from 10% to more than 40% on all U.S. imports—including coffee.

The backlash to the announcement was immediate: Global markets plummeted, other countries reciprocated with tariffs of their own, and multiple experts labeled the tariffs unconstitutional. The Financial Times called Trump’s decision “one of the greatest acts of self-harm in American economic history,” while The Economist described it as “the most profound, harmful and unnecessary economic error in the modern era.” There was even speculation that the administration used generative AI to work out specific tariff rates.

The U.S. is one of the world’s largest coffee markets—in 2023, it imported more coffee than any other country—but it grows very little of its own (less than 1% of all coffee produced globally). Adding 10% to the cost of imports—or even more, depending on the country—will mean price increases along the supply chain, most of which will likely be passed on to consumers.

The ultimate impact of tariffs on the coffee industry is still unclear. Combined with ongoing volatility in the commodity markets, as well as inflation and the continuing effects of climate change, it all adds up to an uncertain time for the industry.

We reached out to stakeholders along the coffee supply chain, from producers and importers to roasters and trade organizations, to understand how tariffs will impact the industry, and to learn about their strategies going forward.

Cataclysmic Consequences

Here’s what we know so far: Most of the world’s coffee-producing countries face at least a 10% tariff, whichTrump placed on all imports to the United States. Such countries include Brazil, Colombia, Guatemala, Costa Rica, Ethiopia, and many more.

“The consequences of the proposed tariffs could be cataclysmic for the industry,” says Christopher Feran, an independent coffee consultant and founder of Aviary Coffee. He notes that the industry is already facing instability, and tariffs will only make things worse. “Not only has inflation wreaked havoc on the industry, as well as labor shortages, but rising credit rates and now the cost of both the C Market and these tariffs.”

The U.S. will place additional tariffs on specific countries, including:

- 46% on Vietnam, the second-largest coffee producer behind Brazil;

- 32% on Indonesia, the fourth-largest producer, responsible for growing 6% of all coffee;

- 26% on India, number seven globally;

- And a whopping 54% on China, a relatively small coffee producer but a major source of machinery and other supplies—like bags and to-go cups—for U.S. coffee companies.

Tariffs are taxes added to goods from foreign countries and paid, in this case, to the U.S. Treasury by importers at the point of entry. While Trump has insisted that the tariffs will be paid by the goods’ countries of origin, in reality most of the costs associated with tariffs have historically been passed on to the consumer.

The Yale Budget Lab estimates that the latest tariffs will result in an average extra cost of $3,800 to American households this year. For coffee, this likely means increased retail costs at cafes and at grocery stores.

Feran says there’s still a lot of uncertainty around what the tariffs will actually look like for buyers. He sent a note to his clients, which he shared with Fresh Cup, recommending that, “in the short term, we plan based on the worst case scenario and what we know at this time.”

Impact at Origin

The effect on coffee producers could also be sizable, as U.S. imports accounted for more than 18% of all coffee grown in 2023. Marianella Baez Jost, a producer and exporter in Costa Rica, says that she and the farmers she works with are concerned, but also confused. “As producers, we can’t understand why would the U.S. impose a tariff on coffee or crops that can’t be produced in the U.S.?” she says.

Baez Jost also imports her own and others’ coffee into the U.S., and says that the tariffs are yet another cost that they will struggle to bear. “Even in a year of higher coffee prices, we are facing higher costs of production, logistics, etc.,” she says. “The margins continue to be too low to absorb extra taxes or tariffs.”

Instead, costs will likely be passed on to the final consumer, says Noah Namowicz, chief operating officer of Cafe Imports, a green importing company. He says that tariffs will be paid at the port of entry, raising costs for importers which will impact downstream prices for roasters and consumers. “That becomes our new cost of goods, so that tariff amount is passed to the roaster and ultimately the end consumers,” Namowicz says.

Coffee farmers—particularly in countries with high tariffs—will be doubly impacted, as roasters look to buy from origins with lower tariffs (we’ve already seen talk of this cost-cutting strategy with the implementation of the EUDR among European countries). “Coffee farmers’ cost of production is also increasing as their raw inputs cost more than ever, so the question becomes what price can the consumption market bear that provides a thriving income for producers and yet keeps roasters and importers in a financial position to keep their businesses afloat,” Namowicz says.

(Lack Of) Industry Response

So what are U.S. coffee trade bodies doing in response? The National Coffee Association (NCA) responded to Fresh Cup’s request for comment immediately. The organization declined to answer specific questions, but provided a statement from president and CEO William “Bill” Murray:

“Every dollar of coffee-related imports generates $43 in value for the American economy, and coffee supports 2.2 million U.S. jobs, all while being America’s favorite beverage. Since coffee beans cannot be grown in most of the United States, trade policies should take into account the essential role of coffee trade in Americans’ daily lives and in the U.S. economy, to ensure that Americans don’t face even higher coffee prices amid the current cost of living crisis.”

The NCA has been working on the issue of tariffs for a while. In March, one of a handful of times Trump threatened to impose tariffs against Canada, Mexico, and Colombia, Murray wrote to U.S. Trade Representative Jamieson Greer to request an exemption for coffee.

In the letter, Murray noted that there is no real domestic alternative to imported coffee, and that imposing tariffs could raise retail prices by up to 50%. An NCA media relations representative also pointed Fresh Cup to a recorded webinar for members, featuring food and trade attorneys who discussed implementation and impacts of the tariffs, among other issues.

The Specialty Coffee Association (SCA) also provided Fresh Cup with a statement, from CEO Yannis Apostolopoulos:

“For decades, coffee value chain actors have been affected by price volatility driven by climate change and myriad sociopolitical factors. This volatility has been exacerbated by the introduction of new tariffs, which have implications for the global economy. As a result, all stakeholders within the value chain, including both coffee producers and consumers, will feel heightened impacts for the foreseeable future. The Specialty Coffee Association collaborates with institutional partners at national and local levels and will continue to support their advocacy efforts regarding trade policies in their respective regions.”

Fresh Cup asked for more specifics regarding the exact steps the organization is taking to support the specialty coffee industry, but the SCA has yet to elaborate or respond to the request to speak directly.

Feran is frustrated by what he views as the current lack of action or communication from the SCA. “Normally you’d rely on your trade organization to appeal to the government for any sort of relief or sanity,” he says. “Instead, the National Coffee Association has stepped in to appeal to the U.S. government for an exemption for coffee and cacao, as it should be, because we cannot produce these commodities. But it’s just reflecting the failure of the SCA to rise to the moment and extend themselves beyond being a marketing organization.”

Chaos and Confusion

Trump’s tariff announcement, although signposted for months and explicitly promised on the campaign trail, has nonetheless caused chaos. In the two days following the announcement, some of the largest publicly traded companies lost $5 trillion in stock market value as markets reacted to the upheaval. Trade expert Inu Manak from the Council on Foreign Relations called the tariffs “the biggest tax hike on Americans since the 1940s.”

The situation remains extremely fluid, with confusion across the coffee industry and beyond, and will likely remain so in the wake of mixed messages from the administration. Negotiations could delay or change tariffs on specific countries or, if the NCA’s lobbying is successful, exempt coffee altogether. Nobody really knows yet.

We have published a live map to track the tariffs country-by-country, and will continue monitoring and reporting on the situation as it develops through our weekly newsletter, Coffee News Club. Sign up for the newsletter to stay up to date.