In 2013, Namrata Asthana and Matt Chitharanjan started Blue Tokai Coffee Roasters out of a small bedroom in Asthana’s parents’ apartment in Delhi. They were looking for a good cup of coffee but couldn’t find one, so they decided to roast their own. Little did they know that they were seeding a specialty movement that would transform how India consumes coffee.

The husband-and-wife duo began with a 500g tabletop roaster and grinder, convincing a handful of growers to sell them export-quality beans. “We actually started without a business plan, more for self-consumption,” Chitharanjan recalls. “We thought there would be other people like us who were looking for specialty coffee because, at that time, it wasn’t really available in India.”

By the end of that year, they had opened a roastery and cafe. “Then it moved to an inflection point where we had to decide whether to keep it a mom-and-pop-style business or raise outside capital and scale,” Chitharanjan says. They ultimately chose to grow their business, because “the opportunity to sell specialty coffee in India was too large.”

The decision proved prescient. A decade later, specialty coffee has exploded in popularity in India. The market, currently valued at $3.01 billion, is expected to more than double over the next six years. Blue Tokai now runs 150-plus cafes across ten major cities, with an average annual revenue of Rs 400 crore ($48 million) as of 2024.

Following close on its heels was Third Wave Coffee Roasters, which opened its first cafe in Bengaluru in southern India in 2016, and has since expanded to 165 outlets in 12 cities. Araku Coffee—a roastery that began by exporting single-origin beans grown by Indigenous farmers in the Araku Valley to countries such as Japan, South Korea, and France—found the domestic market lucrative enough to open a cafe in Bengaluru in 2020 and another in Mumbai in 2023.

Together, these brands are not only changing how Indians drink coffee, but are also reshaping what coffee represents—moving it from a commodity to a craft, and from a daily habit to an experience.

Laying the Groundwork

Before these companies entered the scene, India’s coffee culture was led by second-wave chains. Notably, those included the homegrown Cafe Coffee Day, which opened in the mid 1990s, and international chains like Costa Coffee, The Coffee Bean & Tea Leaf, and Starbucks, which arrived between the late 2000s and early 2010s. These brands introduced Indian consumers to the idea of cafes as markers of a new urban lifestyle—social, upwardly mobile, and aspirational—but largely served mass-produced blends.

It was against this backdrop that small-scale roasters such as Blue Tokai ushered in India’s third wave of coffee, defined by single-origin beans, farm-to-cup traceability, sustainable sourcing, experimental processing, and small-batch roasting.

The uptake, however, was slow. “The first few years were a bit of a slog,” Chitharanjan says. “It’s only in the last few years that the market has taken off.” He attributes the shift to India’s economic growth and rising disposable incomes. “Every year, the consumer base is growing as more and more people enter the middle class and upper-middle class, and so people who can afford to pay for it are now starting to demand better-quality products, including moving from commodity to specialty coffee,” he says.

Much of this growth is being driven by a young, urban demographic, with Millennials and Gen Z emerging as the largest consumer group.

Rahul Reddy, founder of Subko Specialty Coffee Roasters, believes the groundwork for the shift was laid by the very chains that specialty coffee now seeks to differentiate itself from. “If Cafe Coffee Day hadn’t come in and created a cafe and coffee-drinking culture, maybe a Subko wouldn’t exist,” he says. “Similarly, people started understanding coffee as a more premium product through their first experiences with Starbucks.”

But what’s really moved coffee forward in India, according to Chitharanjan, is improved sourcing. He says Blue Tokai works closely with growers to fine-tune processing methods.

That wasn’t easy in the beginning. “When we went to speak to the growers, they were of the opinion that Indian consumers were not ready to pay for good-quality coffee,” he says. “One grower told us, ‘India is a very price-sensitive market. What you’re trying to do, it will never work. You can’t sell specialty arabica here. You have to blend it with robusta or chicory because that’s what Indian consumers want.’”

Today, the company sources coffee from more than 50 estates, including small-scale growers who produce most of India’s coffee. Ashok Kuriyan, managing director of Balanoor Plantations, one of Blue Tokai’s partner estates, says the dynamic has shifted dramatically. “Before the vibrancy in the coffee industry came, we used to encourage our old, traditional roasters to come and visit us and see what we were doing. They weren’t so interested,” Kuriyan says. “But in the last few years, we’ve been developing our relationship with the new cafe roasters. They come and see our processing. Every year, we get about 10 to 15 people visiting.”

These interactions also influence how roasters approach their craft. At Subko, Reddy is moving past dark roasts to focus on lighter roasts that highlight florality, sweetness, and jamminess. “These wholly new flavor experiences for the Indian market have moved the industry toward seeing specialty coffee in a new light,” he explains.

An Educated Palate

Consumers, too, are becoming more aware of provenance and flavor. Rohan Kuriyan, manager of corporate affairs at Balanoor and son of Ashok Kuriyan, has seen that shift firsthand. “When I joined the industry in 2010, you went to a cafe to chat with your friends. You weren’t too bothered about what coffee it was or where it came from,” he says. “Now, baristas are so knowledgeable. They know where the coffee comes from, what the roast character is, what the flavor notes are. Customers themselves want to know more about the coffee and who the grower is, and that’s a phenomenal move forward.”

While milk-based coffees still dominate about three-quarters of Blue Tokai’s sales, and a significant portion of Subko’s, Reddy sees growing interest in black coffee and cold brew—even if many consumers are looking for flavored options. He still takes that as a win. “There are a lot of people drinking flavored black coffee who otherwise would never have had coffee without milk,” he says.

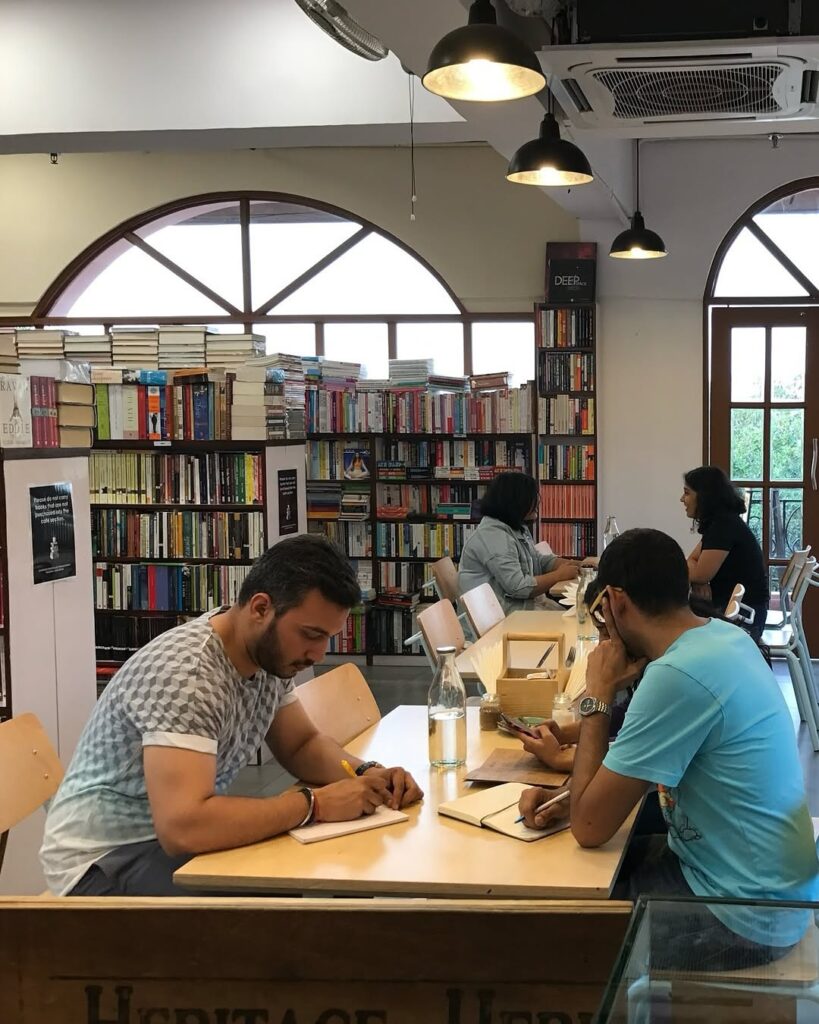

With their design-conscious spaces, specialty cafes have also become “third places” of sorts catering to those seeking community and leisure. Moreover, as more people began working remotely during the pandemic, the need for spaces outside the home grew, and cafés, coworking spaces, and roasteries quickly filled that role. These “away-from-home” venues now make up the fastest-growing segment of India’s specialty coffee market.

Cafe owners are building on this energy by offering curated experiences to draw customers in. Araku’s 6,000-square-foot, multi-level Bengaluru cafe features multiple brewing stations, tasting bars, and on-site roasting, alongside a bookshop. Design and experiential elements are also at the heart of Subko, whose larger cafes include reading rooms, plug-in work zones, and manual-brewing trolleys where customers can watch baristas at work.

The Rise of Home Brewing

What’s taken many in India’s coffee industry by surprise is the growing popularity of home brewing. “Since most Indians were working from home during the pandemic, they needed to buy coffee and brewing equipment,” says Chitharanjan. Retail packets—packaged beans or ground coffee sold through cafes, stores, or online—currently make up 15% of Blue Tokai’s sales, and the company has seen a steady increase in both retail coffee and equipment purchases in recent years.

At Roastery Coffee House, which runs 15 cafes in 6 cities across India, founder Nishant Sinha has seen a significant rise in the in-store sales of retail coffee. “When we started our first cafe in Hyderabad in 2017, people used to come and buy Rs 10,000 ($113) worth of roasted coffee in a month to brew at home. Now our monthly in-store sales are around Rs 10 lakh ($11,322),” he says. India’s coffee-equipment market is expected to grow more than 6% annually in the coming years, signaling the ongoing popularity of home brewing.

What’s driving home consumption is not only access to equipment but also the effort cafe owners are putting into educating customers. “Ten years ago, you would have never imagined that you would have coffee training sessions and workshops taking place day in and day out,” says Rohan Kuriyan. “Now, every weekend, some cafe is conducting a session on brewing or cupping.”

The result is a coffee culture that’s more informed, interconnected, and ambitious than ever. “From a consumer’s point of view, it’s very exciting. We’re just about touching the surface of the coffee industry in India. There’s tremendous potential ahead,” Rohan Kuriyan says.